What makes an NFT valuable? Here are 5 things to look for in an NFT project [2022]

I’m sure by now you’ve heard about Non-Fungible Tokens, otherwise known as NFTs. You hear these stories about JPEGs of apes selling for $250,000, and a 12 - year old making over $1 million selling pixelated pictures of whales as NFTs. If you’re like me, you’re probably wondering, am I in the wrong profession, or are NFTs a money-laundering scam? It’s a little bit more complicated than that.

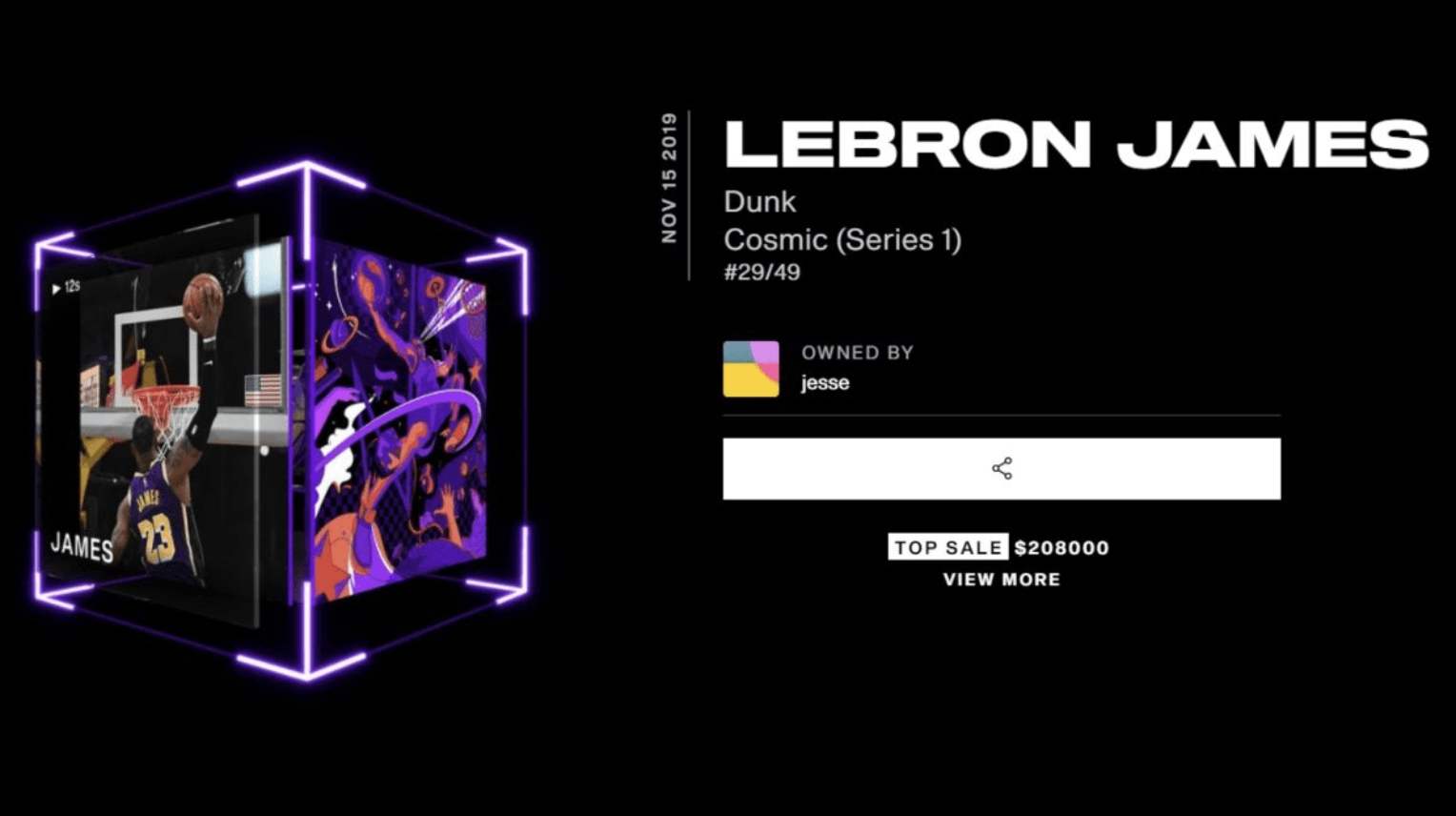

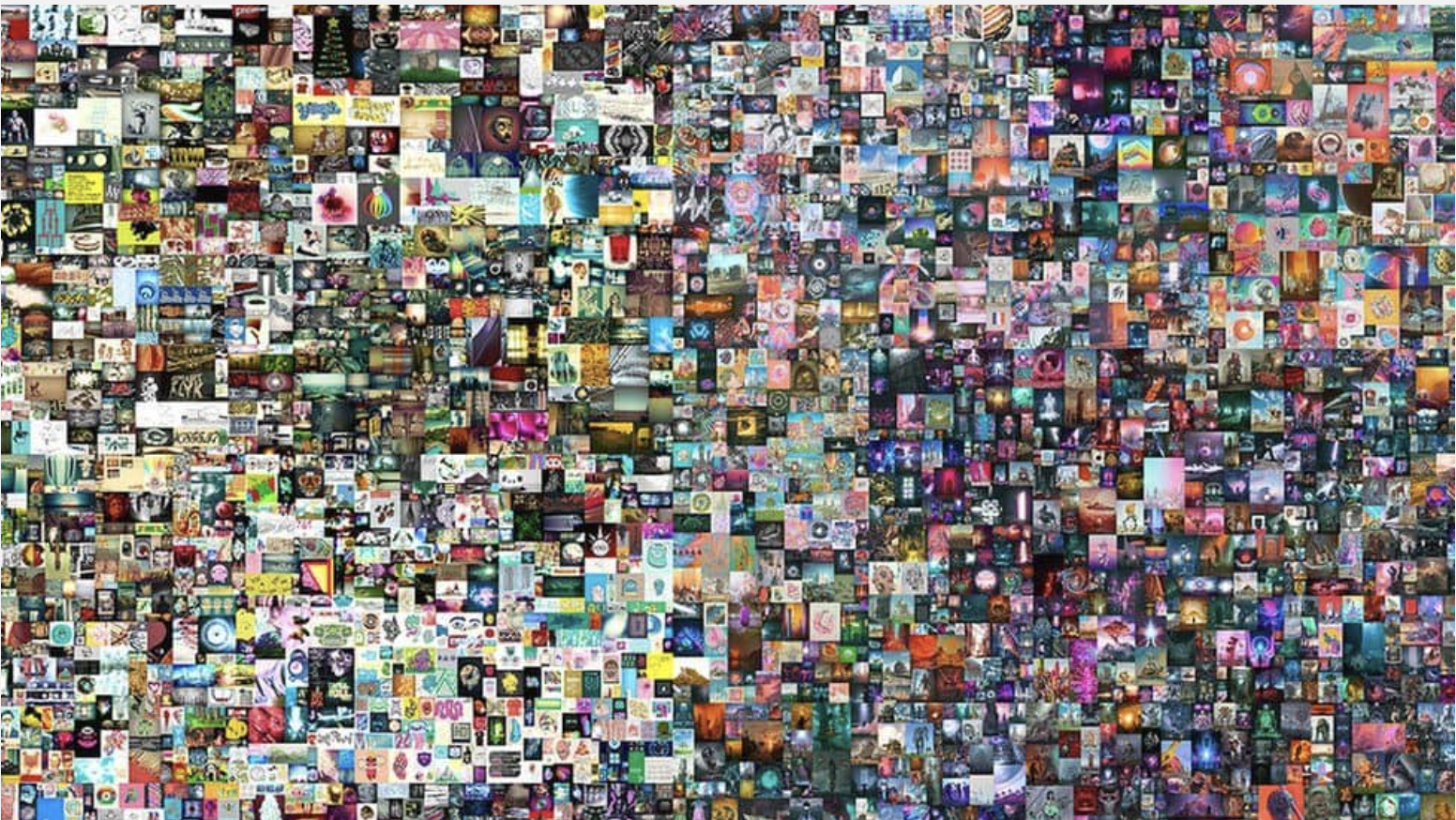

In 2020, NFTs reached a trading volume of $1 million for the first time ever. In 2021, NFTs sales skyrocketed to about $25 billion. In that year, we witnessed one of the most expensive NFTs to be ever sold – Beeple’s “The First 5000 Days” – for over $69 million. It seemed that 2021 was the year in which everyone making an NFT was making money. Now in 2022, NFT sales have declined quite a bit. Many consider the NFT market to be a bubble waiting to be popped.

Entrepreneur and CEO of VaynerMedia, Gary Vaynerchuk, believes that “98% of [NFT] projects are going to zero.” It also doesn’t help that we are experiencing what many consider to be a crypto bear market which has already wiped-out billions of dollars in market value across the NFT market.

Does that mean that NFTs were a quick fad? Absolutely not. The NFT market is just beginning and is experiencing innovation that will allow the market to stabilize. As per Jefferies’ report, The NFT Industry will hit a valuation of $80 billion (USD) by the year 2025.

The incredible innovation happening in the NFT space will greatly benefit creators down the road. NFTs will offer creators a whole new way to directly monetize their work with their fans and provide value. Now that isn’t to say that anyone that creates an NFT project will find success. In this article, we’ll go over five key elements of what makes an NFT project valuable.

UTILITY

For most NFTs, utility is a factor in determining the value of the NFT. In other words, owning the NFT will allow you to use it for something down the road.

Utilization varies depending on the type of project. For example, Logan Paul just released his NFT collection “The Originals” which consists of 99 of his own photos. These photos are now minted as NFTs. People that buy from an NFT collection will get access to unique perks for the specific photo, membership to Originals DAO (Decentralized Autonomous Organization), and a Creative Commons license.

Here are some possible kinds of utility that we’ve found in the market:

Gaming - NFTs that can be used in a virtual game or Metaverse itself.

Music - Artists are minting songs and albums as NFTs which allows them to cut out middlemen and keep creative control. Buyers might receive perks such as exclusive content, collaboration possibilities, and signed physical copies.

Film – Filmmakers are using NFTs to raise capital, engage with their communities, and access more revenue streams. The utility of owning these types of NFTs includes access to special events such as festivals and film seminars, actor meet and greets, digital collectibles, and royalties.

Art – These digital assets are mostly meant to be displayed, just like tangible works of art. We see art being showcased in virtual galleries in the Metaverse, or as profile pictures for social media handles.

COMMUNITY

Most valuable NFT projects have a huge community behind them. Having a community indicates that there’s a potential base to monetize and engage with. Think of an NFT community as a virtual town square. It is a place for members to engage with one another and feel connected.

The true power of NFT communities lies within the incredible marketing power that they can unleash on social media as customers transform into ambassadors. Having a strong NFT community will provide social proof and help with engagement and growth. Social proof is important because it provides a sense of trust in the project. Members of NFT communities want to help and contribute to the success of the project.

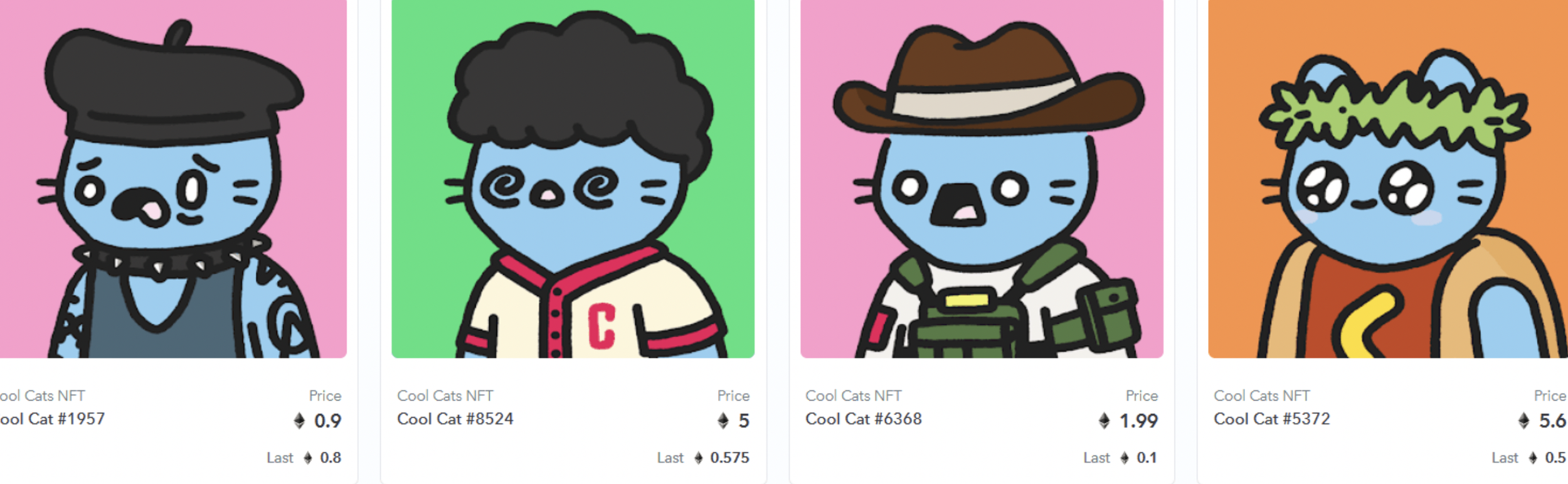

Some of the best NFT communities today include Bored Ape Yacht Club (BAYC), CryptoPunks, Cool Cats, World Of Women, and Alien Frens.

RARITY

An NFT, at its core, is a digital asset. Like any asset, value can be determined by supply and demand. If there is an infinite amount of a specific asset (not taking into consideration barriers to entry and discrimination) the price of the asset should be low since theoretically anyone can buy it. On the contrary, if there’s a finite amount of an asset and a high demand for it, then the price will rise as buyers compete in the open market.

The rarer an NFT is, the more valuable it becomes. Take for example the Bored Apes Yacht Club collection. There are 10,000 unique profile pictures in this collection; however, not all of them are the same price. Some of these profile pictures have different features, traits, or characteristics which make them rarer than others from the same collection. It’s these rarities that drive massive increases in value.

Think of it this way: would you rather have something that everyone has? Or would you have something one of a kind?

FOUNDING TEAM/CREATOR

During our experience with working and interviewing NFT creators, we’ve found that the person or team behind an NFT project is important. Does this creator, or team, have a history of previous success? Are they even real people?

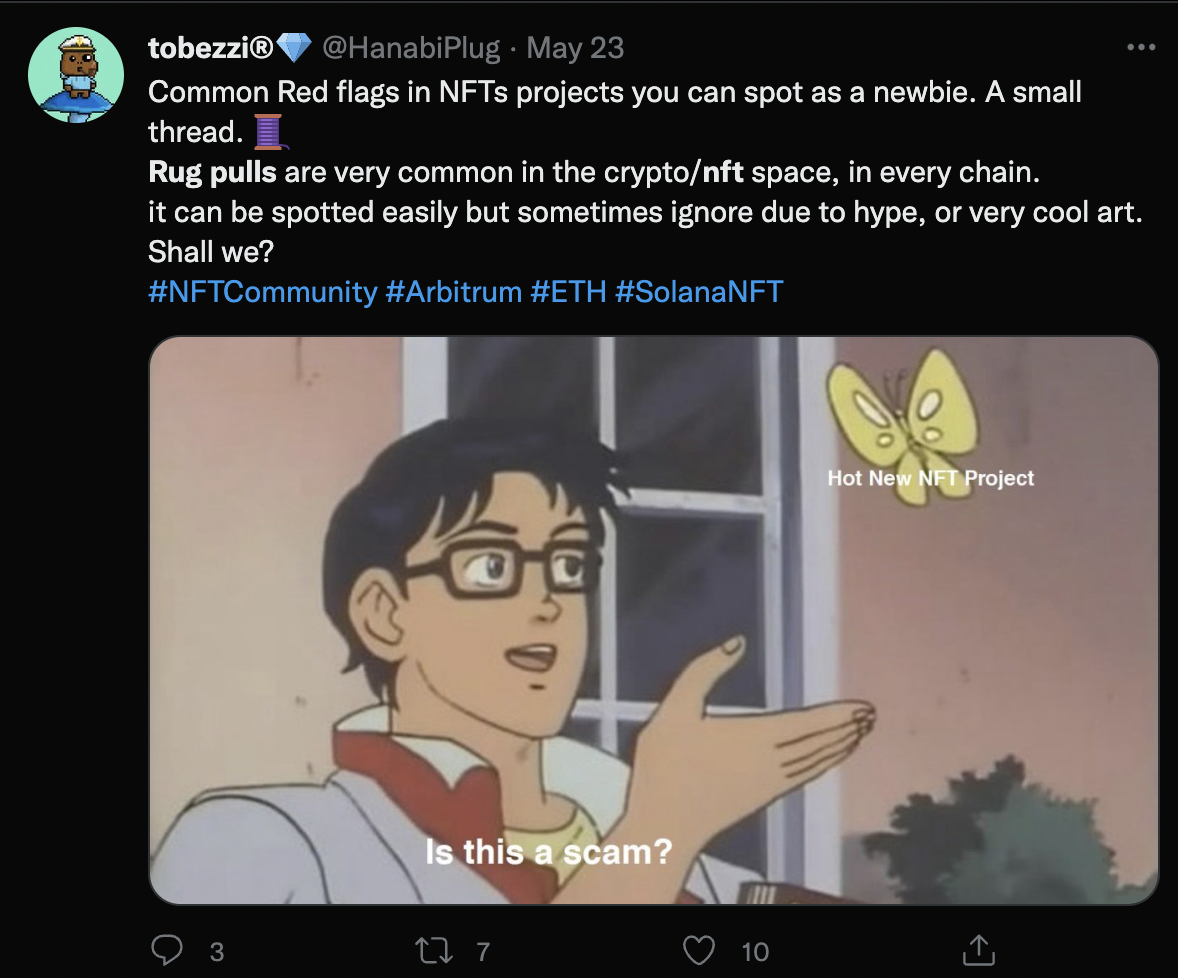

Unfortunately, the NFT market has experienced rug pulls and projects failing due to unrealistic utility promises.

A good way to approach this concept is to think of it from an investor standpoint. Take for example Elon Musk who has a proven record of start-up success. If Elon Musk were to create an NFT project, would you trust him?

If you’re expecting people to spend their hard-earned cash on your NFT, you should be able to prove to them that they can trust you to succeed. Having a proven track record is a must. Don’t promise something that you can’t deliver.

LIQUIDITY

Liquidity refers to the degree to which an asset or security can be bought or sold in the market without affecting the asset’s price. It is a term that we’ve often associated with a company’s ability to convert its assets into cash. High liquidity is a sign to investors that they would be able to quickly convert their shares to cash should they choose to.

For NFTs, high liquidity is a sign of higher value. However, if an NFT has low liquidity, it means you do not have enough buyers to pay at that price. When this happens, you may be required to sell at a lower price or wait for more people to join the market before you can sell. This is not attractive to NFT investors and collectors.

That is why blue-chip NFTs such as BAYC, CryptoPunks, and World Of Women, continue to be sought after.

CONCLUSION

For creators new to the NFT space, we know that it can be daunting at first; don’t let that stop you from realizing the potential creative empowerment that NFTs can offer. The creative revolution is just beginning.

To sum it up, just remember these key elements of what makes an NFT valuable:

Utility

Community

Founding Team/Creator

Rarity

Liquidity

Follow our Instagram page to stay up to date with our latest news, tips, and insights on creative empowerment.